Yousef Khalawi and AlBaraka Forum for Islamic Economy Transform Islamic Finance into a Global Ethical Powerhouse

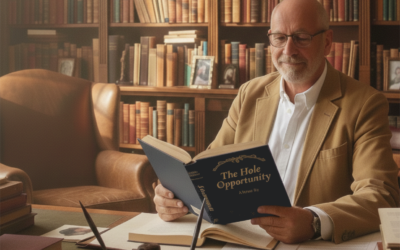

Photo: H.E. Yousef Khalawi, Visionary Leader of AlBaraka Forum, Championing Ethical Finance and Innovative Global Economic Solutions.

Islamic Finance: A Pathway to Ethical and Inclusive Growth

Through AlBaraka Forum, Yousef Khalawi advances Islamic finance, blending ethical principles with innovation. His efforts drive global growth, foster inclusivity, and empower communities worldwide, setting new standards for sustainable financial systems.

I n a world increasingly seeking ethical, sustainable, and inclusive financial systems, Islamic finance stands as a robust and transformative model. H.E. Mr. Yousef Khalawi, a globally respected leader in the Islamic economy, offers unparalleled insights into the opportunities and challenges shaping this rapidly expanding industry. His career, spanning continents and influential roles, reflects a deep commitment to values-based economic frameworks and innovative thinking.

As the Secretary General of the AlBaraka Forum for Islamic Economy and the Islamic Chamber of Commerce, Industry and Agriculture, Mr. Khalawi has been at the forefront of numerous industry advancements. Under his stewardship, these organisations have played pivotal roles in strengthening the foundations of Islamic finance globally. In this comprehensive conversation, Mr. Khalawi sheds light on the driving forces, barriers, and future potential of Islamic finance while emphasising its universal appeal and relevance.

Global Islamic finance is projected to grow to $9.7 trillion by 2029.

The Thriving Global Environment for Islamic Finance

The global Islamic finance industry is forecast to reach $9.7 trillion by 2029, and for good reason. According to Mr. Khalawi, this growth is driven by increasing demand for ethical, transparent, and sustainable financial systems. Islamic finance, with its principles of risk-sharing, equity, asset-backing, and interest-free transactions, aligns seamlessly with modern ESG (Environmental, Social, and Governance) standards. This alignment has made Islamic financial products attractive to a wide audience, including non-Muslim markets.

UK’s success story as a model for integrating Islamic finance in non-Muslim markets.

The broader Islamic economy, encompassing sectors like halal food (valued at $1.43 trillion) and halal tourism ($326 billion), continues to fuel the need for Sharia-compliant financial services worldwide. Non-Muslim countries such as the UK, Luxembourg, South Africa, and Thailand are actively enhancing their Islamic finance regulatory frameworks, demonstrating the increasing integration of Islamic finance into global economies.

Yousef Khalawi exemplifies visionary leadership, revolutionising Islamic finance through innovation, inclusivity, and ethical principles, inspiring transformative change globally.

At the same time, digital innovation is reshaping the industry. Islamic fintech, which facilitates financial inclusion through digital banks, robo-advisors, and blockchain-based zakat platforms, is proving to be a powerful enabler for younger generations. With global digital transactions projected to reach $306 billion by 2027, fintech solutions are making Sharia-compliant financial products more accessible than ever before.

Opportunities for Non-Muslim Markets

Non-Muslim markets present a vast area of opportunity for Islamic finance, especially in ethical and sustainable investments. ESG sukuk (bonds compliant with Islamic financial principles) have already reached over $50 billion in issuances, financing significant renewable energy and infrastructure projects. Non-Muslim markets are also exploring innovative Sharia-compliant financial products such as halal mortgages, ethical investment funds, and pensions.

“Islamic finance is more than a religious framework; it’s a universal blueprint for ethical, transparent, and inclusive financial systems.”

The United Kingdom serves as a prime example of successful integration. By ensuring tax neutrality, robust regulatory frameworks, and providing Sharia-compliant liquidity tools like the Bank of England’s Alternative Liquidity Facility, the UK proves that Islamic finance can thrive alongside traditional financial systems. Countries such as Australia, Brazil, and Canada are now exploring similar approaches to tap into growing demand.

Challenges and Solutions

Despite its growing appeal, Islamic finance still faces challenges in non-Muslim markets. Regulatory unfamiliarity with Islamic financial models, misconceptions about the exclusivity of the system, lack of professional expertise, and strong competition from conventional financial institutions hinder its broader adoption.

“Non-Muslim markets like the UK have proven that Islamic finance can strengthen any financial ecosystem when supported by clear regulations.”

Mr. Khalawi asserts that these challenges can be overcome through collaborative efforts, capacity-building, and public education. Regulatory harmonisation, akin to the UK model, is essential for ensuring a level playing field, while initiatives to train banking professionals, Sharia experts, and fintech developers are critical for fostering growth. Public awareness campaigns, meanwhile, are vital for showcasing Islamic finance as a transparent, ethical alternative that is universally applicable.

Education and Knowledge Sharing

Mr. Khalawi places significant emphasis on education as a cornerstone for the industry’s future. The AlBaraka Forum for Islamic Economy has offered hundreds of grants and research opportunities to young academics, including participants in the Durham Islamic Finance Summer School and PhD students across leading universities. By supporting emerging scholars, hosting global summits, and aligning with prestigious initiatives like the Saleh Kamel Islamic Economics Awards, the Forum continues to enrich academic and professional knowledge in Islamic finance.

Beyond academia, media platforms and digital tools are simplifying Islamic finance concepts, making them more digestible for general audiences. Islamic social finance, including zakat (charitable giving) and waqf (endowments), further bridges the gap by demonstrating Islamic ethical frameworks in practice.

Governments as Key Architects

Governments and policymakers play crucial roles in fostering the growth of Islamic finance. Mr. Khalawi commends the UK’s proactive approach, which includes sovereign sukuk issuances, Sharia-compliant banking tools, and fintech advances. Other Western markets, including Germany, Luxembourg, and France, are following suit, but more impactful policies are needed to strengthen their presence in the sector.

When governments align with Islamic economic principles, it not only boosts investment flows and consumer confidence but also creates a more inclusive financial system. For example, the issuance of green sukuk to fund renewable energy projects exemplifies how sustainable goals can be achieved through Islamic financial models.

The Role of Collaboration and Innovation

Collaboration lies at the heart of Islamic finance’s global success. Platforms such as the AlBaraka Summit bring together regulators, investors, scholars, and fintech entrepreneurs to promote knowledge sharing, enhance global visibility, and harmonise Sharia governance standards. These collaborations support cross-border investments in ESG projects, fintech innovations, and high-impact infrastructure developments.

Indeed, Islamic fintech represents one of the brightest opportunities for the sector. Digital banks, robo-advisors, and ethical micro-investment tools have struck a chord with Gen Z and millennial consumers, further broadening the reach of Islamic financial products. The innovations emerging from hubs like London and Kuala Lumpur have global resonance, with underserved markets in Africa, Southeast Asia, and the Americas tapping into this newfound accessibility.

Transformative Potential

When asked about the long-term global impact of Islamic finance, Mr. Khalawi envisions a future where it becomes a central pillar of ethical capitalism. Its focus on fairness, transparency, and asset-backed investments fosters growth in critical sectors like housing, education, agriculture, and renewable energy. Green sukuk, for instance, are playing an instrumental role in financing environmentally friendly projects, while interest-free microfinance tools continue to empower vulnerable communities worldwide.

Ultimately, Islamic finance is about creating systems that are not just profitable but also just. By marrying ethical principles with innovative technologies, Islamic finance offers a model for reshaping global economic systems to be more inclusive, transparent, and sustainable. As Mr. Khalawi suggests, its values are universal, transcending religious boundaries to address some of the world’s most pressing economic and social challenges.

Through his work with AlBaraka Forum and other institutions, Mr. Khalawi continues to demonstrate that Islamic finance is not merely about financial transactions; it is a transformative framework for achieving fairness and equity across global markets. In today’s fast-evolving economic landscape, it is a solution worth exploring for all nations.