Islamic Finance Set to Hit $9.7 Trillion by 2029 as UK’s Role Expands in Ethical Financial Ecosystem

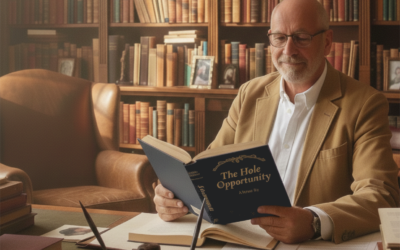

Photo: H.E. Yousef Hassan Khalawi, Secretary General of the AlBaraka Forum, highlighting Islamic finance as a transformative global economic model at the London Summit.

Summit Reframes Islamic Finance as a Global Solution

The AlBaraka Summit in London spotlighted Islamic finance growth, the UK’s leadership role, and innovative solutions amid challenges like policy gaps and public misconceptions, forecasting a $9.7 trillion industry by 2029.

T he fourth AlBaraka Summit, held at London’s JW Marriott Grosvenor Hotel, underscored the growing momentum of Islamic finance, not only within Muslim-majority nations but increasingly across global, non-Muslim markets. With global Islamic finance assets forecast to surge to $9.7 trillion by 2029, the summit highlighted the importance of collaboration, education, and supportive government policies in propelling this sector forward.

Projections indicate Islamic finance assets will grow to $9.7 trillion by 2029.

Bringing together prominent figures including CEOs, policymakers, investors, and scholars, the summit served as a platform for forward-looking dialogue. The spotlight was firmly on the United Kingdom, positioned as a key player in advancing Islamic finance across the Western world, thanks to its robust financial infrastructure and deep ties to investment markets in the Middle East and Asia. Yet, attendees were quick to highlight key barriers to growth, such as limited public understanding of Islamic finance and fragmented policy frameworks, which risk stifling both innovation and broader adoption.

“The UK’s financial services sector generated a trade surplus of over £100 billion in 2023, underscoring its competitive edge.” – H.E. Yousef Hassan Khalawi

The event commenced with keynote addresses from H.E. Yousef Hassan Khalawi, Secretary General of the AlBaraka Forum, and Lord Dominic Johnson, member of the UK House of Lords and former Investment Minister. Both leaders emphasised the rising global demand for values-based, sustainable, and ethical financial models. “The UK’s financial services sector generated a trade surplus of over £100 billion in 2023, underscoring its competitive edge,” remarked Khalawi, adding that embracing Islamic finance could further solidify the nation’s leadership in global markets.

“The technology exists, the market is ready, the opportunity is there.” – H.E. Yousef Hassan Khalawi

The UK as a Hub for Islamic Finance

A key takeaway from the summit was the UK’s pivotal role in the Islamic finance ecosystem. Speakers painted a picture of London’s financial sector as a bridge between Western economies and Sharia-compliant investment opportunities, with insights from high-profile leaders such as H.E. Dr. Abdurrahman Abdullahi, Deputy Director of the Central Bank of Nigeria, and Charles Haresnape, CEO of Gatehouse Bank. The presence of global participants, including figures from South Africa to the Philippines, underscored the universal resonance of Islamic financial principles.

The summit also explored innovations in ethical finance, showing how Islamic finance offers solutions to real-world challenges, whether in sustainable investment or interest-free loan models. For instance, the United States was cited as a case study, where alternative, Sharia-compliant student loan programs have seen strong demand, demonstrating the global appetite for economic inclusivity.

Challenges and Strategic Recommendations

“Islamic finance is not a niche concept but a globally relevant, ethical model grounded in sustainable growth.” – AlBaraka Forum

While the growth potential of Islamic finance is evident, speakers emphasised the need for strategic action to overcome hurdles. These include public misconceptions about the inclusivity of Islamic finance, gaps in policy support, and a lack of financial literacy around Sharia-compliant systems. Key recommendations included:

- Holistic Policy Frameworks: Developing cohesive government policies that support Sharia-compliant finance across sectors, from corporate finance to insurance.

- Education and Awareness: Launching educational campaigns to demystify Islamic finance and demonstrate its accessibility for non-Muslim communities.

- Community Integration: Collaborating with local communities and leveraging digital tools to engage the younger generation.

- Focus on SMEs: Creating tailored solutions for small and medium-sized enterprises, which have traditionally faced limited access to financial tools tailored to their needs.

Discussions also touched on the unique timing for growth, driven by demographic shifts, greater digital adoption, and infrastructure needs. “The UK is at a crossroads,” Khalawi said. “The technology exists, the market is ready, the opportunity is there.”

“Tailored solutions for SMEs can unleash new economic opportunities in Sharia-compliant markets.” – AlBaraka Forum

A Global Economic Model, Not a Niche Concept

One of the most striking themes of the summit was a reframing of Islamic finance, steering away from its traditional perception as a niche offering. Instead, speakers framed it as a globally relevant, ethical model grounded in sustainable and resilient growth. With its strong emphasis on social equity, inclusivity, and environmental stewardship, Islamic finance aligns with growing global interest in ESG (environmental, social, and governance)-focused investment.

In conjunction with the proceedings, the AlBaraka Forum premiered its documentary, “Sustainable Futures: Islamic Economy, Global Impact.” The film echoed the day’s discussions, illustrating how Islamic finance principles are being applied across sectors and continents to drive inclusive and enduring growth.

The Bigger Picture

Founded by the late Sheikh Saleh Abdullah Kamel—and now a leading voice in advancing the Islamic economy globally—the AlBaraka Forum has emerged as a key driver of dialogue and cooperation. The London summit is part of a broader series of events designed to strengthen the integration of Islamic economic principles in diverse markets. Past summits have been held across key economic hubs, from Saudi Arabia to Turkey.

As the Islamic finance industry evolves, it is clear that its core principles—ethical, interest-free, and community-driven—have universal appeal. Non-Muslim-majority nations are waking up to these values, and the UK’s leadership role in fostering this global narrative has only begun to take shape. The discussions at AlBaraka’s London summit reaffirmed the sector’s potential and laid a solid foundation for what could become a $10 trillion global force by the end of the decade.